Hi {{First name | there}},

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This week we look back on major changes in the last 3 months, and what they mean going forwards.

Enjoy!

The Scouting Report

Key insights

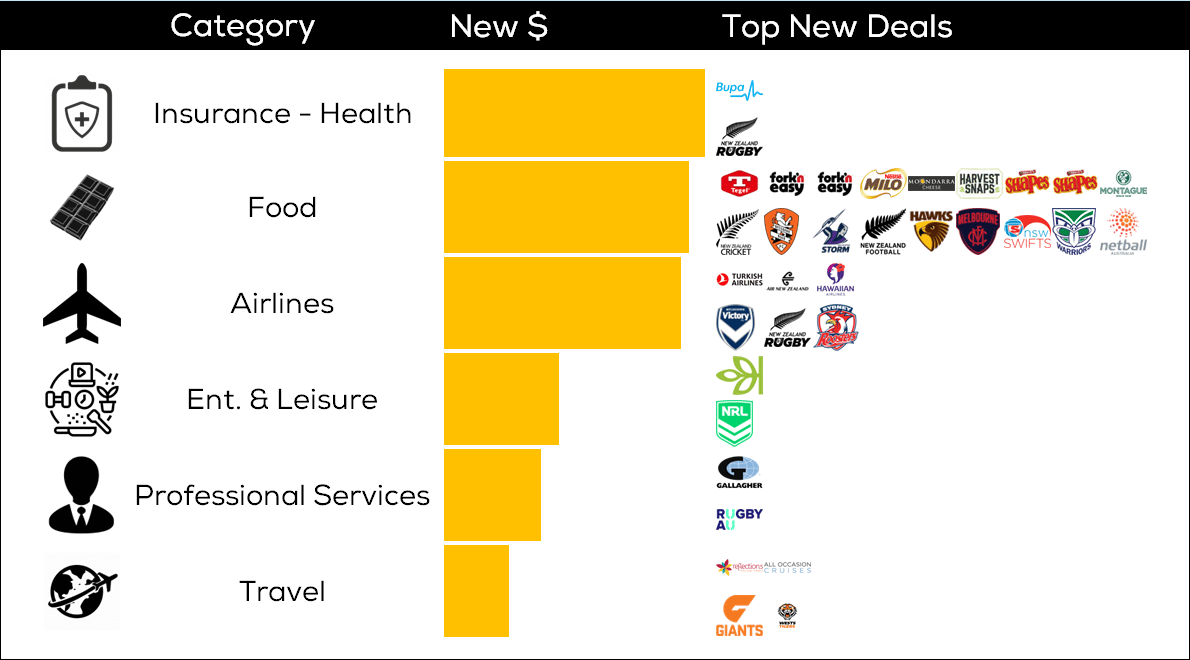

The fastest growing categories in the last quarter have been Private Health Insurance, Food and Airlines.

Growth has mainly come in the form of a small number of high profile deals, with ripple effects for their respective categories.

Food is an exception, with 13 lower tier deals in the last 3 months, suiting smaller investment levels.

Melbourne Rebels leave behind a sponsorship portfolio of over 30 brands, likely to have budget to spend elsewhere.

Most active categories in Q2 2024

Top categories for new deals in Q2 2024, with select example deals

Growth in sponsorship spend has mainly come in the form of a small number of high profile deals within a category. For example:

Health insurer Bupa became a global partner of New Zealand Rugby; Ancestry.com signed NRL and Gallagher swapped League for Union.

Turkish Airlines replaced Bonza at Melbourne Victory; Hawaiian became a lower Tier partner for Roosters; and Air NZ upgraded their NZ Rugby status from Regional to Global partner

Travel brands All Occasions Cruises and Reflections Holiday Parks signed Tier 2 deals with Wests Tigers and Giants respectively, following strong Travel growth in Q1. Do these deals represent prosperous times for Australia’s travel industry, with more to come?

These major deals can cause big swings in sponsorship share of voice for all brands within a category. Shifts in the category can make existing partnerships all the more important for protecting share, or new partnerships more appealing for fighting back.

For example, check out last week’s article on the impact of Queensland Country Bank’s sponsorship on the Banking category as a whole.

Growing appetite for Food sponsorship?

The food category has grown significantly based on volume of deals, rather than deal size, with 13 new partnerships in the last 3 months alone. These are generally at lower levels, suiting lower-tier asset packages. Healthy and convenient options aimed at busy, health-conscious sports audiences (e.g. Lite n’Easy and Fork’n Easy) have seen especially high growth in the last 12 months. Teams without a Food partner would be well-placed to further explore the category.

Scout Market Map - Food sponsorships (showing highest ranked for each club/league)

NB for the purpose of this analysis, Food is grouped into one category, but can be subdivided into competitive streams.

Ex-sponsors of Rebels without a cause?

It was announced this quarter that the Melbourne Rebels will sadly no longer compete in Super Rugby. While sponsors still have the opportunity to stick with Rugby Victoria, others might be looking to re-invest their Rebels spend in Australia’s other major teams and leagues.

Rebels portfolio (top 20) & revenue from each category compared to benchmarks

Analysing the Rebels portfolio, they performed particularly well in the (non-Banking) Finance category, from a Tier 1 partnership with Ebury. Finance typically makes up 3% of Clubland investment (2% in Rugby Union, and 6% in Victoria), with the Rebels-Ebury deal surpassing all of these benchmarks. Will Ebury look to deploy these funds elsewhere?

Most Rebels partners sponsor other Clubs too. Sponsorship already plays an important role in the marketing strategy of these brands. Teams that can demonstrate how they benchmark and complement existing brand activity will be best-placed to capitalise on the Rebels-shaped void.

Check out the Dockers case study for more on how Scout’s portfolio analysis can help with prospect identification and messaging.

More about Scout’s Landscape Insights Reports…

For a sponsorship landscape overview, with insights bespoke to your Club/Brand, State, Sport, and Season, reach out for a chat.

Sponsorship Landscape Reports cover:

Which categories invest most in sponsorship?

Which categories are growing / shrinking net spend?

Which categories are growing / shrinking total activity?

What are the top new/expired deals in L3M & L12M?

How does the above vary for your State / Sport / Season?

Which categories are especially invested in your State / Sport / Season?

Which brands are under-represented within your State / Sport / Season?

For this and more, reach out below:

Are you hiring? Get in touch with our partner business, Talent Economy.

Partner with industry experts, Talent Economy, to unearth top talent across the Aussie media, sport, entertainment and marketing sectors. Head to talenteconomy.com.au, follow on LinkedIn or email [email protected].