Hi {{First name | there}},

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This week we take a look Queensland Country Bank’s new Principal Partnership with the Heat and the broader ramifications for the Banking sponsorship market.

Enjoy!

QCB sign on as Heat Principal Partner for next 3-years

The Scouting Report

Context

Last week the Brisbane Heat announced a landmark new deal with Queensland Country Bank to be their Principal Partner for the next 3-years.

QCB CEO Aaron Newman said staff and members alike were excited to be stepping onto the pitch with the Heat “We have a strong focus on supporting communities and this aligns perfectly with Queensland Cricket”.

The deal comes after category rival Great Southern Bank announced their exit of an 8-year relationship with the Heat.

Taking over one of the few Tier 1 Banking deals across the country, along with their Naming Rights deal with North Queensland Stadium, QCB now command a huge share of the Banking sponsorship market, especially relative to their size.

Market share in Banking

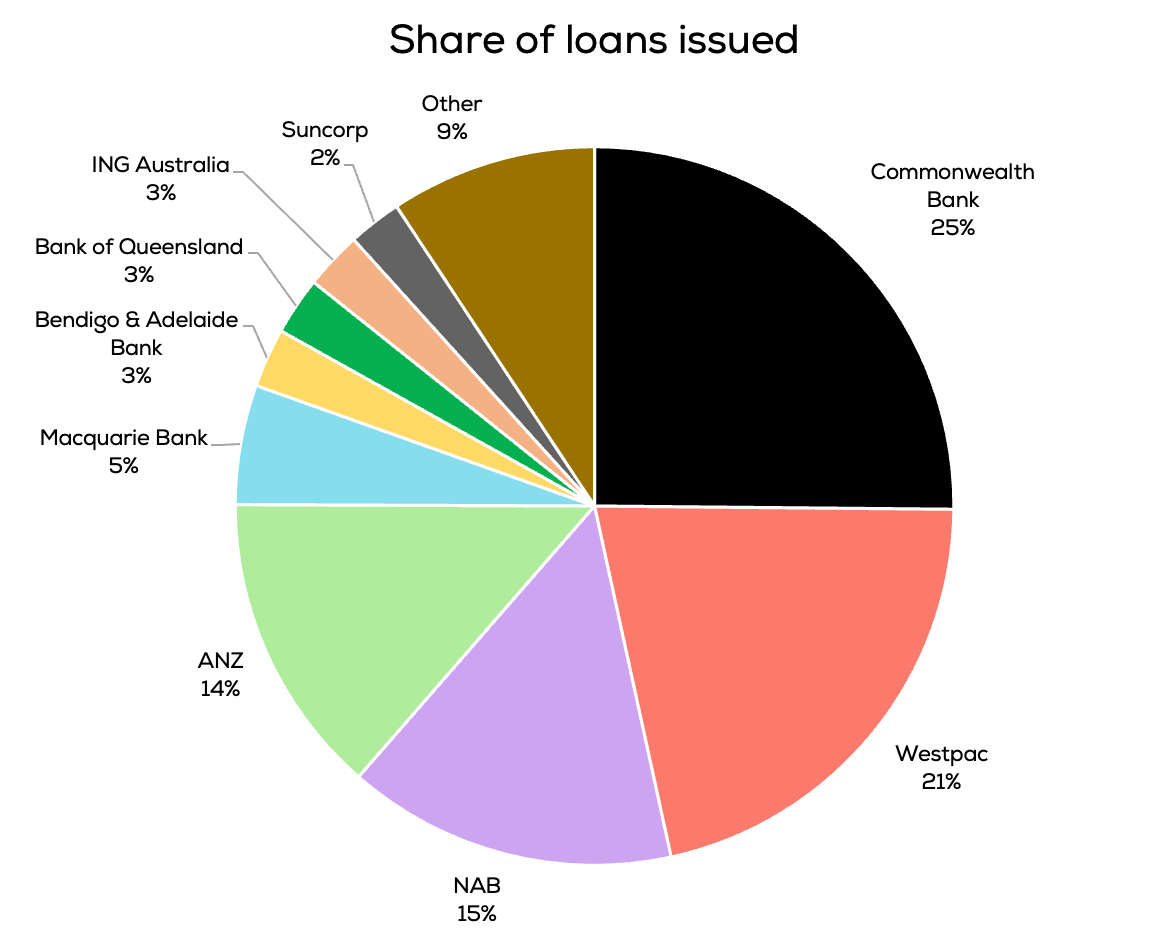

Share of household loans (Source: APRA May-2024)

As they are widely known, the “Big 4” dominate the Banking sector, accounting for three quarters of loans to households in Australia. QCB are 26th by rank at just 0.11% share of the loans market.

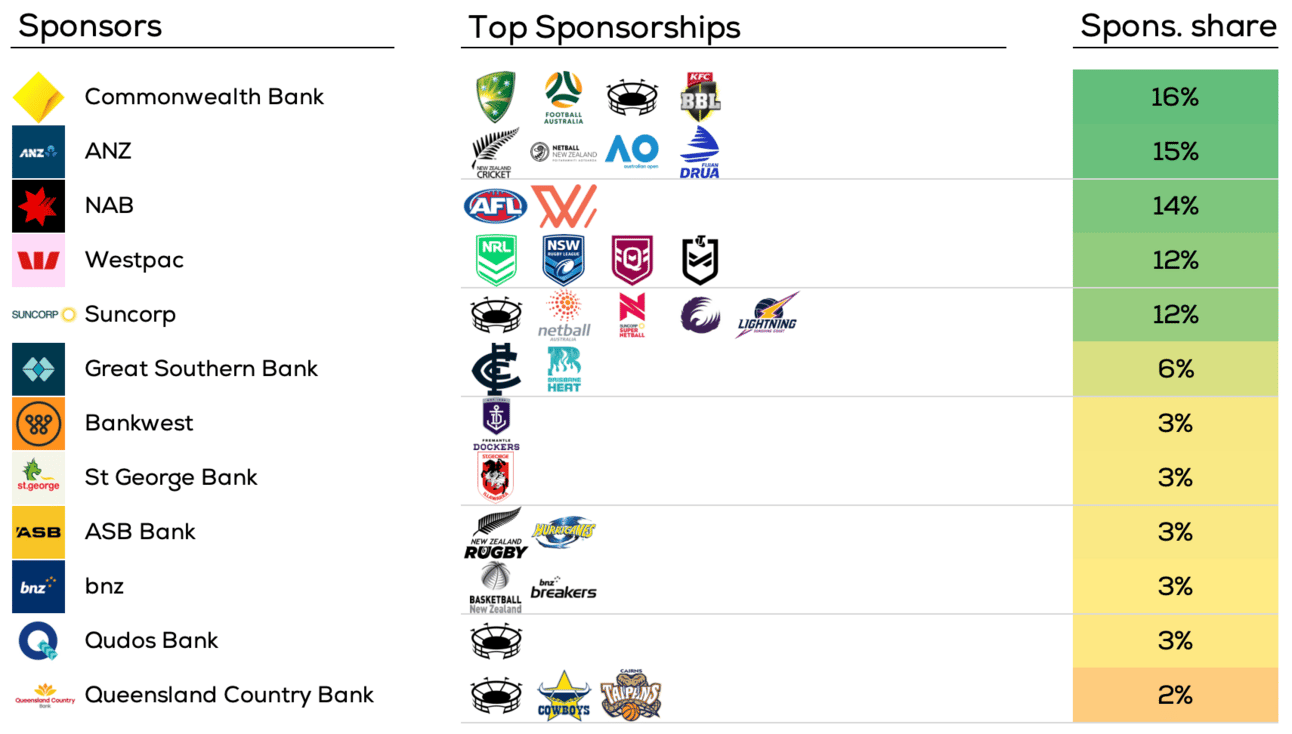

Sponsorship share in Banking

Share of sponsorship share (prior to Heat deal)

Sponsorship share largely follows market share, with the Big 4 also leading the way. However, QCB and other smaller brands significantly outspend their market position creating the perception of being larger than they are:

Great Southern Bank (6% of sponsorship vs 0.7% of loans)

Qudos Bank (3% of sponsorship vs 0.2% of loans)

Queensland Country Bank (2% of sponsorship vs 0.1% of loans)

QCB and Brisbane Heat - a great match

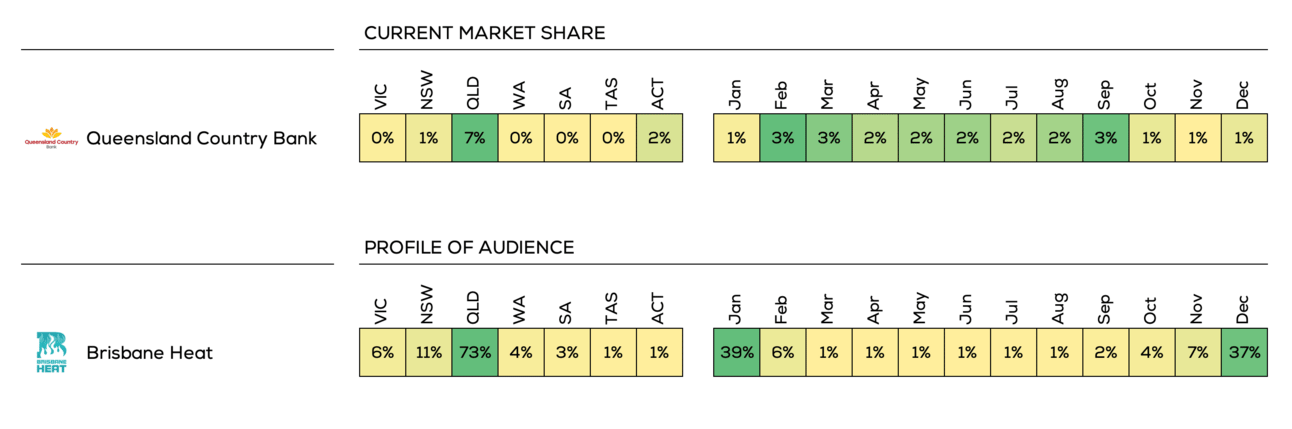

QCB’s portfolio is dominated by North Queensland Stadium and the Cowboys, meaning their presence amongst sports fans is strongest during the winter months.

The Heat give QCB access to the Brisbane market during the critical summer months where they are currently lacking.

Partnership needs-matching

What does this mean to the Banking sponsorship market?

Even prior to this deal, QCB’s activity in sponsorship far outweighed their overall market position. This deal more than doubles their share of the market making them the 7th largest Australian sponsorship spender in Banking - at a similar position to Great Southern Bank.

Amongst Queensland audiences, QCB’s position is even stronger with the Heat deal pushing their sponsorship share to 13%, jumping above Commonwealth Bank and ANZ. They now sit in 3rd behind only Suncorp and Westpac; a position far exceeding their market size.

Without the Heat deal, Great Southern Bank’s share of the Queensland sponsorship market fell outside the top 10. Our last article showed a weakness in NSW for GSB - will they look to redeploy the Heat spend here?

Sponsorship share before vs after new Heat deal (Top 10 QLD share)

To explore any of these themes further, or for another category, see our website or reach out for a chat: