Good Morning,

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This Week in Sponsorship is a weekly wrap up of the latest deals and renewals with a special focus on the Deal of the Week or other noteworthy sponsorship related topics. Check out previous articles

Enjoy!

20th November 2024

AFL Fixture 2025 - implications for teams and sponsors

Context:

Last week, the AFL released the 2025 fixture, with timeslots confirmed to Round 15.

Overall, the AFL’s decision to increase the number of Thursday and Sunday night matches, with fewer overlapping on Saturday night, is expected to boost audiences. However, this impact is felt differently for each team.

This week we explore how match timeslots for each Club are likely to affect their audiences, and therefore benefits to sponsors.

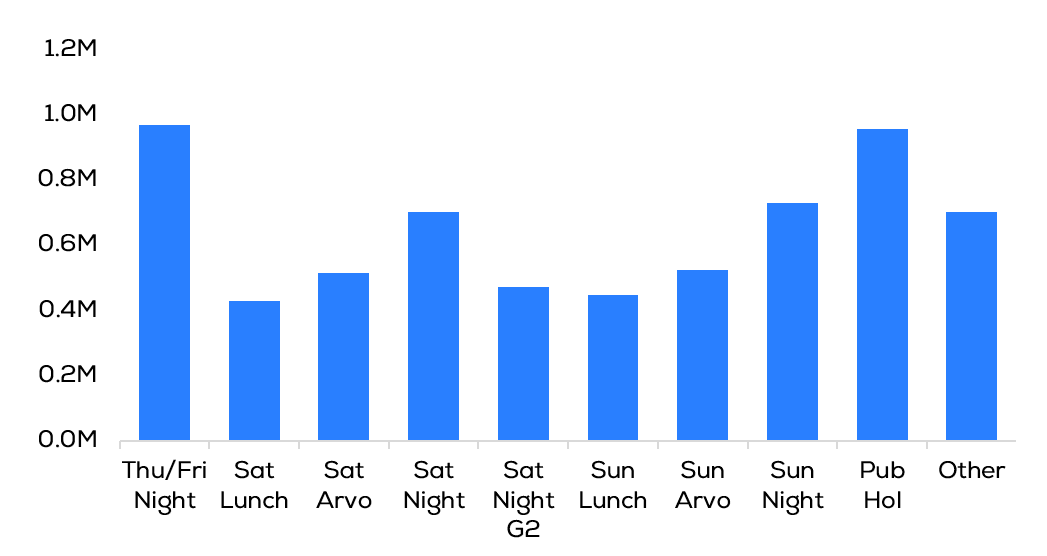

What is the expected average audience from each timeslot?

Across all sports, one of the biggest drivers of TV audience is the timeslot.

AFL match average audience, by timeslot

For example, Thursday/Friday AFL night matches historically attract an average audience of around 1 million viewers, due to primetime audiences; and national coverage on Seven.

Meanwhile, other timeslots such as Saturday lunchtime have less than half as many viewers, due to daytime scheduling, and less free-to-air coverage (only in certain States).

By overlaying each team’s fixture against the average audience of these timeslots, we can see which teams will have the highest projected audience for 2025.

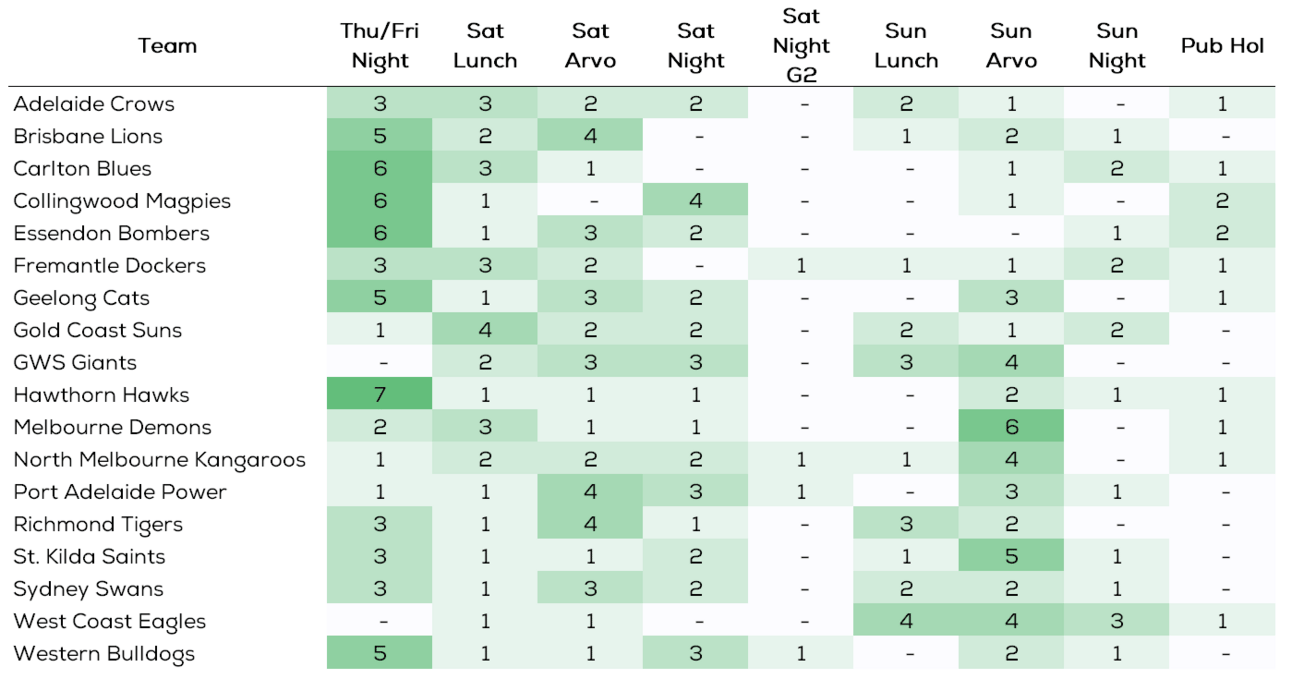

How many timeslots does each team get in the 2025 AFL fixture? (to Round 15)

# Matches in each timeslot, by Club

There are large variations in fixturing for each Club, with important implications for audiences and sponsors. To name a few:

Hawthorn will have seven Thursday / Friday night fixtures in the first 15 Rounds, more than any other Club (and compared to none in the same period in 2024).

West Coast Eagles have a particularly Sunday-skewed fixture. While this represents fewer primetime matches, it may benefit Financial Services sponsors such as Lendi, reaching audiences at home before Mondays, where banking activity peaks for customers.

Gold Coast Suns have more lunchtime fixtures than any other team. Whilst generally the lowest rating timeslots, lunchtime activity will suit their newest jersey sponsor in Zambrero.

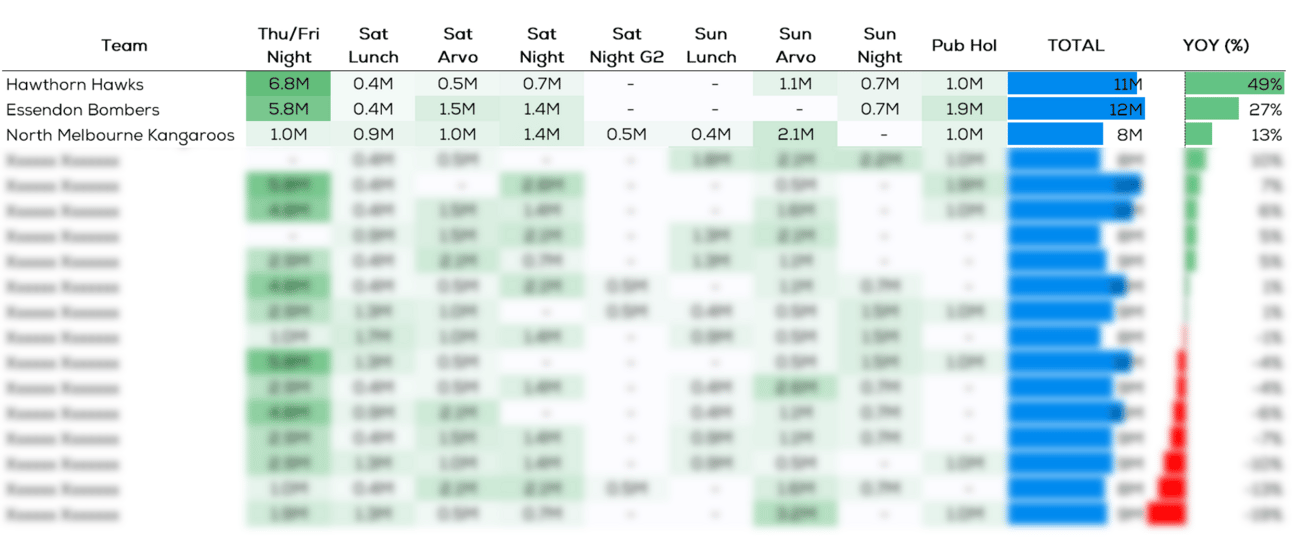

Applying the timeslot average audience x number of timeslots for each club

# Matches in each timeslot, by Club

When applying timeslot averages to each team’s fixture:

Hawthorn are the biggest winners year-on-year, with timeslot changes projecting 49% year-on-year growth in audiences.

All things being equal, this would deliver 49% more TV media value to Hawthorn sponsors in 2025 R1-15. Digging a little deeper, Hawks primetime matches are primarily away games, and so this will primarily benefit Kit sponsors (e.g. Tasmania, KFC, Nissan, Superhero), rather than signage sponsors, which appear only at home games.

Essendon are expected to have the highest cumulative audience after R15, with strong year-on-year growth. The Club may consider a comms strategy around this success to support PR and partner story-telling.

Despite coming from a lower base, North Melbourne’s audiences are projected to grow by 13%, driven by their first Thu/Fri night match since 2022, and fewer lunchtimes.

Clubs likely to see year-on-year declines can start strategic planning, e.g. managing partner expectations early, considering more relevant benchmarks, or devising other value drivers such as enhanced digital assets.

To learn more about Scout’s Benchmarking services, helping sports with proactive insights for partners and prospects, drop us a note. Benchmarking covers fixtures, attendances, audiences, coverage, search, social followers, social engagements and more.

About the analysis

This analysis is based solely on historic timeslots. A full model would account for identity of teams, marquee fixtures, full broadcast information and unknown variables such as team performance, or a competitive match. However, average audiences for each timeslot provide a starting point for projecting audiences, for a directional view. The analysis is based on 2023/2024 H&A audiences, as reported publicly (OzTam, VPM), assigned by timeslot. It does not account for major shifts in broadcast arrangements in 2025, or new scenarios such as streaming, or the increased number of head-to-head matches vs NRL. Lunch = pre-2pm AET, Night = post 6PM AET.

This Week In Sponsorship: Notable deals

NEW

🏉 St George Illawarra Dragons announced a new three-year partnership with business lender Dynamoney as their official business lender. Dynamoney will take the under-number position on the back of the club’s NRL and NRLW jerseys for the 2025, 2026 and 2027 seasons.

🏉 The Dragons also revealed a new three-year partnership with leading Australian investment firm Remara, set to feature on the sternum of the jerseys across both teams.

⚽️ Sydney FC announced a two-year partnership with Sony Australia & New Zealand, as the Membership Partner and exclusive Audio Partner for club.

⚽️ Melbourne Victory confirmed Zib Digital as the Club's Premier Digital Marketing Partner for the 2024/25 season.

🏏 Melbourne Renegades and Cricket Victoria signed a new partnership with ASX-listed property and development company Mirvac.

⚾ Perth Heat welcomed WA commercial services provider Theme Group as a major partner ahead of the Australian Baseball League season.

RENEWALS

🏐 West Coast Fever have signed a three-year renewal with Gold Industry Group as joint Principal Partner, in a deal worth over $2m per year. Gold Industry Group Chair Kelly Carter said the partnership “… reflects a shared commitment to breaking down barriers, supporting female leadership, and fostering inclusive communities across WA.”

🎾The Australian Open and Marriott Bonvoy announced an exclusive multiyear partnership extension. The partnership is focused on experiential assets to further boost brand awareness and program engagement, and increase occupancy and revenue in their ten Melbourne hotels.

🏉 Essendon’s partnership with the world’s leading probiotic beverage company Yakult has renewed for 2025, taking their tenure to over 20 years.

🏉 Wests Tigers have seen construction company PAMA upgrade their partnership to become Premier Sternum Partner for 2025 across all jerseys.

🏉 Cronulla Sharks have re-signed men’s health brand Pilot on an upgraded deal to take the sternum asset from 2025 for a further two seasons

Not yet subscribed?

Sign-up to receive these articles direct to your inbox.

Our services

Reach out for a chat to learn more:

Are you hiring? Get in touch with our partner business, Talent Economy.

Partner with industry experts, Talent Economy, to unearth top talent across the Aussie media, sport, entertainment and marketing sectors. Head to talenteconomy.com.au, follow on LinkedIn or email [email protected].