Good Morning,

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This Week in Sponsorship is a weekly wrap up of the latest deals and renewals with a special focus on the Deal of the Week or other noteworthy sponsorship related topics. Check out previous articles

Enjoy!

4th December 2024

Deal of the week

Wests Tigers x Pepper Money

Brand: Pepper Money

HQ: Sydney

Category: Non-Bank Lending

Deal type: Upgrade/Renewal

Context: Last week, the Wests Tigers announced an upgraded renewal with non-bank lender, Pepper Money, becoming the club’s major sponsor for the next three seasons. The multi-million-dollar deal will see Pepper Money worn on the front of both the NRL and NRLW team jerseys.

What do we know about the Non-Bank Lending category?

Firstly, what is a non-bank lender? Traditional banks (e.g. Big 4) fund their lending activities through customer deposits, whereas non-Bank lenders have their own sources of wholesale funds, primarily through securitisation. These funds are usually acquired at lower rates meaning they can often offer cheaper rates to customers. The downside of non-bank lenders is that their smaller size and security puts them at higher risk during times of economic uncertainty.

There has been growing preference for non-bank lending over traditional banks in recent years. According to Brighten Home Loans’ 2024 borrower survey, 61% of prospective home buyers in the next 5 years are considering loans from non-bank lenders. (source)

This research is supported by a 2023 RBA report which states that non-bank lending is growing at more than twice the rate recorded by banks, nearly doubling its share of the housing credit market in the last 10 years. (source)

Non-bank lenders in sponsorship

Non-bank lenders currently spend a combined $16M+ per annum on sport sponsorship, approximately a quarter of what is spent by traditional banks. With non-bank lending pegged to continue increasing its share of the housing credit market, is it fair to assume that marketing and sponsorship budgets will follow suit?

Scout: Top categories by overall spend on sports sponsorship

Whilst mid-pack (compared to other sectors) when it comes to overall sponsorship investment, non-bank lenders tend to do large deals. In fact, they are behind only watch brands when it comes to the % of deals in the category that are done above a $1M threshold (38%). These top tier deals can help non-bank lenders appear as more credible, especially when generally considered as riskier than traditional banks.

Scout: Top categories by % of deals >$1M per annum (prior to Pepper Money upgrade)

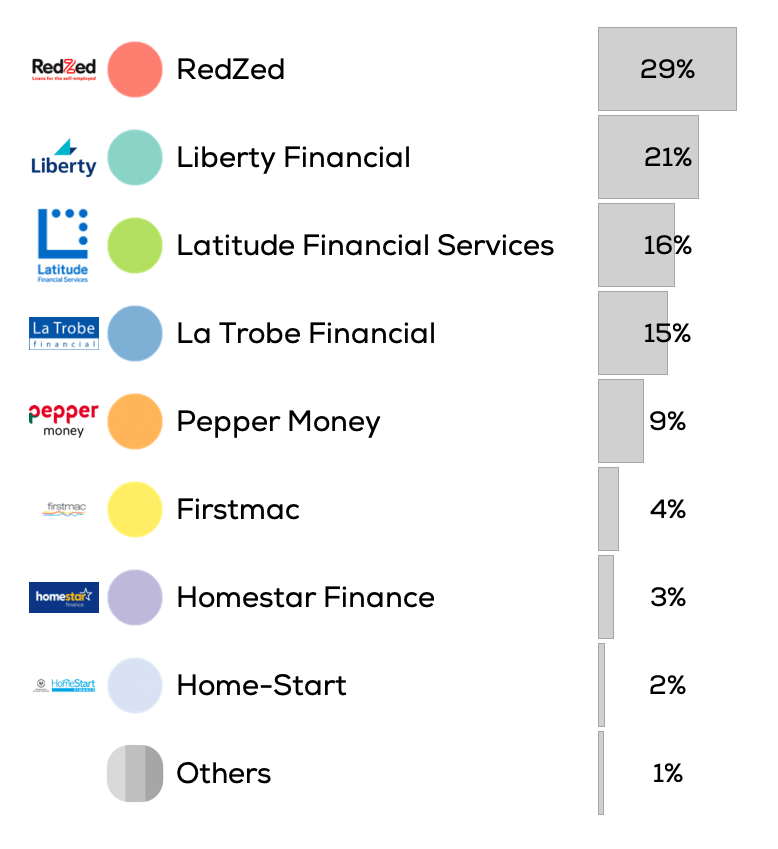

Prior to the Wests Tigers upgrade, the category was dominated by 4 Brands (RedZed, Liberty, Latitude and La Trobe), each holding at least one Tier 1 sponsorship with a major club and combining for over 85% share of spend.

Scout: Category share of sponsorship spend (before deal)

Pepper Money’s new deal propels them into this mix with a category share just shy of 10%, stealing share from competitor brands.

Scout: Category share of sponsorship spend (after deal)

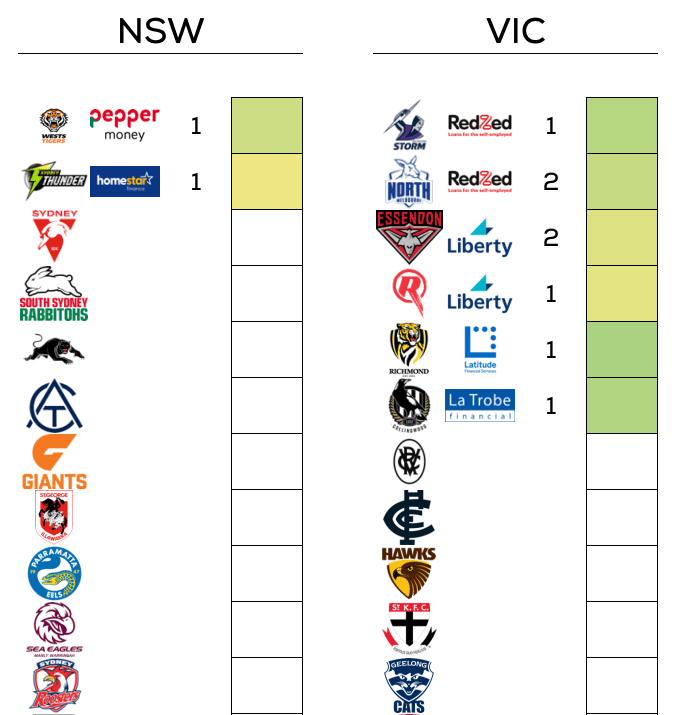

Furthermore, the Top 4 sponsors have their key deals concentrated in Victoria, giving Pepper Money a clean environment (in the largest state) to reach fans without heavy competitor clutter.

Scout: Top non-bank lender sponsorships

Scout: Non-bank lender sponsorships in NSW and VIC

Along with Banking, the combined “Lending” sector is now spending $80M+ per year on sports sponsorships, second only to Auto. This spend is distributed across a small number of high value and high profile deals, leaving the vast majority of clubs still searching for a lending partner. Whilst the traditional institutional Banks tend to favour league-level partnerships (in part to manage brand reputation risk), non-bank lenders have shown a much greater willingness to partner with clubs (particularly at major Tiers), and should be considered high value targets in clubland.

Scout data above as of October 1st 2024 with inclusion of Pepper Money x Tigers upgrade where relevant

Notable deals of the week

NEW

🏉 Suntory Oceania and the New Zealand Warriors have signed two new partnerships for the 2025 NRL season, kicking off a multi-year deal with Gatorade as the club’s ‘Official Hydration Partner’ and V Energy as the ‘Official Energy Drink Partner’.

🏏 HOME Docklands, a leader in the Build-to-Rent sector, has teamed up with the Melbourne Renegades to become the Official Accommodation Partner for the 2024/25 WBBL and BBL seasons.

🏉 The NSW Rugby League (NSWRL) is proud to announce a five-year partnership with leading multinational sportswear manufacturer, adidas, who will join as the official apparel and footwear partner featuring on the men’s and women’s Origin team playing kits from 2025 until 2029.

🏉 The British & Irish Lions and Rugby Australia have announced the Great Barrier Reef Foundation as their chosen Global Charity Partner. The partnership will focus on engaging fans through awareness campaigns, educational experiences and fundraising opportunities during the tour.

⛳️ Golf Australia have announced a new partnership with Australian drinks specialist Liquorland. As part of an expanded three-year partnership, Liquorland, which has more than 800 stores across Australia, will be a major partner of Golf Australia and its flagship tournament, the ISPS HANDA Australian Open.

🏉 The South Sydney Rabbitohs have announced Wahu, Australia’s iconic beach and outdoor brand, as the Club’s official Membership Partner for the 2025 and 2026 NRL Seasons.

⚽️ The Central Coast Mariners have announced Dyson Logistics as the new Front of Shirt partner for the club’s AFC Champions League campaign.

🏐 The Melbourne Vixens have announced New Balance as their official apparel partner starting in 2025. The global sportswear brand will provide the team’s playing and training kits for the next three years, while also producing a range of merchandise for fans.

🏉 Pacific Fishing Company Pte Limited (PAFCO) has joined the Fijian Drua’s family of sponsors with its “Sun Bell” brand. As part of the new three-year sponsorship deal, the Fijian Drua and PAFCO have also announced the launch of the inaugural Sun Bell Drua 10s tournament.

🏉 The West Coast Eagles and Playbk Sports have announced a strategic partnership aimed at enhancing the club’s connection with fans across the Western Australian community.

RENEWALS/UPGRADES

🏉 Wests Tigers have announced an upgraded renewal with non-bank lender, Pepper Money, as the club’s major sponsor for the next three seasons. The multi-million-dollar deal will see Pepper Money worn on the front of both the NRL and NRLW team jerseys.

🏉 TFH has extended their Major Partnership of the Queensland Reds, a third extension of the partnership since first coming on board in July 2020. The announcement follows recent re-signings of partners Ringers Western, La Banderita and Dritimes.

🏉 The Newcastle Knights are proud to announce the extension of their partnership with Ausure Insurance Brokers for a further 4 years which will see them align with the Club until 2029. The renewed partnership will see Ausure continue to feature prominently on the Knights’ playing and training shorts.

🏉 Mazda Australia has confirmed its ongoing support of the North Melbourne Kangaroos AFLW side as major partner in 2025. The extension will take Mazda Australia into their eighth season as sole major partner of the team with its logo proudly displayed on the front and back of the playing guernsey.

⚽️ Melbourne Victory have announced the expansion of its partnership with Jones Engineering, which has joined the Club as a Premier Partner for the 2024/25 season.

Not yet subscribed?

Sign-up to receive these articles direct to your inbox.

Our services

Reach out for a chat to learn more:

Are you hiring? Get in touch with our partner business, Talent Economy.

Partner with industry experts, Talent Economy, to unearth top talent across the Aussie media, sport, entertainment and marketing sectors. Head to talenteconomy.com.au, follow on LinkedIn or email [email protected].