Hi {{First name | there}},

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This week we take a look at the Superannuation category, following Aware Super’s new deal with the GWS Giants.

Enjoy!

The Scouting Report

Key insights

The GWS Giants have signed Aware Super as their superannuation partner for the next two seasons. The partnership celebrates Aware Super’s strong presence in Western Sydney, where it provides superannuation and retirement services and advice to nearly 200,000 locals.

Despite strong industry performance, Super sponsorship has declined in recent years, perhaps driven by scrutiny over spending, resulting in new mandates to publish all marketing expenditure

Hostplus has held firm on sponsorship, and seen impressive growth in membership in the last two years

The Giants deal brings Aware Super’s sponsorship share of voice better in line with its share of market, providing a platform to improve its membership growth, which currently lags competitors.

Share of Market

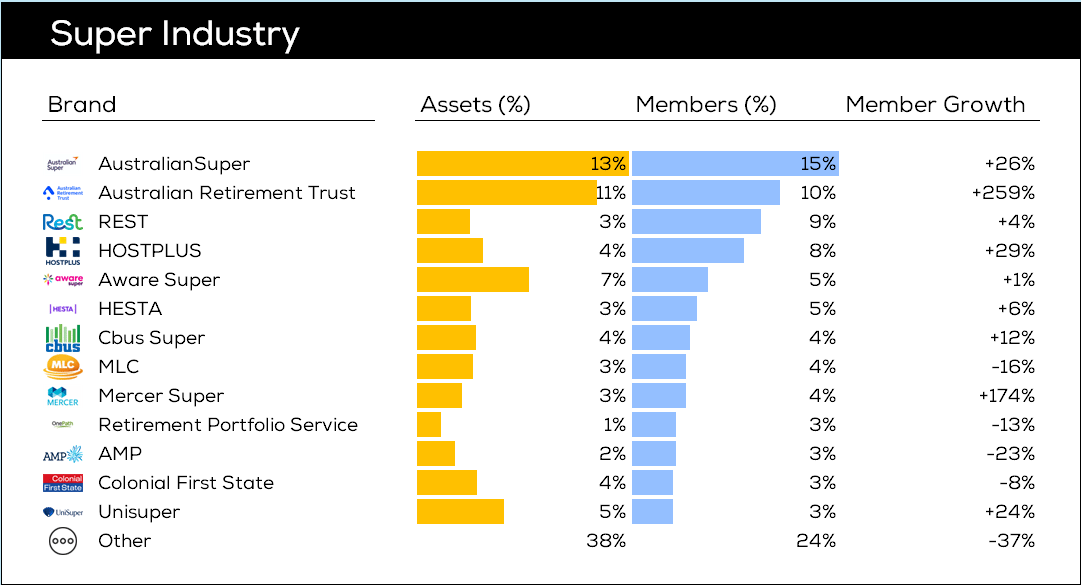

The Super industry has seen strong growth in recent years, driven by the performance of global financial markets. AustralianSuper leads a very fragmented market, with 15% share of members. Growth in membership share varies significantly by fund, driven partly by mergers, partly by acquiring and retaining members, where marketing activity plays a key role.

Super Share of Market (Funds managed. no. of members, share growth since FY21) , APRA

Marketing Spend

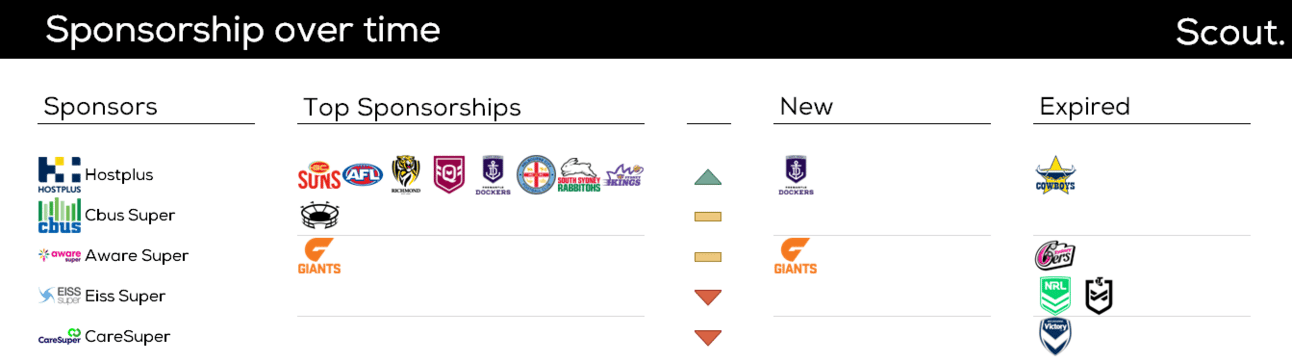

Following scrutiny around marketing spend, APRA conducted a 2021 review into the ($87M) spend of the top Super funds. It concluded that there was a basis for the spend, but it too often lacked quantitative rigour behind the decision making. From 2023, funds have been required to publicise full details of their marketing expenditure to improve accountability for spending. This may have been a detractor for some brands away from sponsorship, with few new deals in the last two years, and exits for EISS (NRL) and CareSuper (Victory).

Changes in Super sponsorship since 2022

Share of Sponsorship

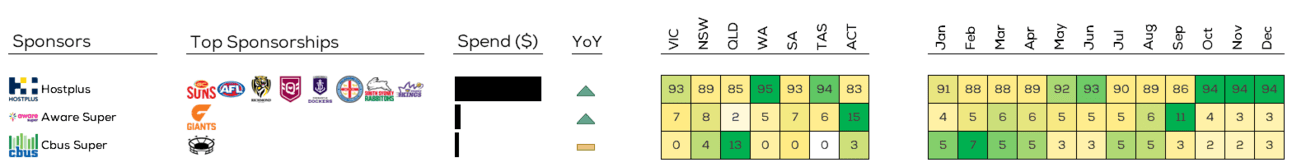

Hostplus has held firm with its sponsorship strategy, through a portfolio covering multiple sports and States. In doing so, its share of Super sponsorship investment has been more than 90%, creating an excess share of voice. In the same period, Hostplus grew its share of membership by 29% - while this partly reflects mergers, Hostplus has punched above its weight for rollover new members - a potential proof point on the impact of sponsorship.

Super Share of Sponsorship, by Brand and Deal

Reach out privately for a summary of publicly-reported sponsorship spend in the Super industry.

Impact of Aware Super x Giants

The Giants audience profile skews towards NSW, VIC and ACT, growing Aware Super’s sponsorship share of voice most in those markets. However, share in Queensland remains very low, due to Giants’ lower audience interest in the State, and a more competitive Super category (Cbus Super Stadium, and Hostplus x Suns, QRL and Bullets). Share also remains low during summer, due to the Giants winter skew. If Aware Super’s objective is a year-round national footprint, it may wish to consider a QLD-based team playing in summer, e.g. Heat, Roar, or Taipans, who would complement the Giants’ audience profile.

Why Aware x Giants could be a Super sponsorship

As well as influencing share of sponsorship, further considerations for Aware Super include:

Aware Super sits between Hostplus and Cbus for # members, but has only grown its membership share by 1% since 2021, lagging other key players. The Giants sponsorship brings its sponsorship share of voice more in line with its share of market, providing a platform to improve membership growth.

Aware Super has a relatively low share of members, relative to its assets under management (i.e. its average per user is higher than rivals). This might suggests growing members is a priority (as opposed to seeking higher-value customers).

The company is one of few NSW-based Super funds, providing an opportunity to authentically “connect with and support our members living in Western Sydney” (CEO Deanne Stewart). The partnership will help drive awareness of Aware Super’s community focused campaigns, such as helping to improve financial literacy.

Aware Super has one of the most female-skewed membership bases across all Super funds, slightly older than average too. As the youngest Club in the AFL, the Giants represent an opportunity to reach younger audiences, skewing more male.

While partnership measurement should depend on brand objectives, understanding sponsorship share of voice provides a quantitative starting point for making decisions.

To see market share v sponsorship share for any sponsorship category, and the role different teams can have in influencing it, reach out for a chat:

Are you hiring? Get in touch with our partner business, Talent Economy.

Partner with industry experts, Talent Economy, to unearth top talent across the Aussie media, sport, entertainment and marketing sectors. Head to talenteconomy.com.au, follow on LinkedIn or email [email protected].