- Scout

- Posts

- Monthly Intel Report - October

Monthly Intel Report - October

The categories and brands to watch - October 2025

Good morning,

We’re excited to bring you our latest Monthly Intel Report. Each month, we cover:

Sponsorships to watch (notable new/expired deals)

Brands to watch (most active, new entrants)

Categories to watch (most active, fastest growing)

Switch to an annual plan for access to Scout’s Brand Directory and to save $188 on your monthly subscription. More info on Scout subscription options.

Enjoy!

Problems with how this email displays? Click Read Online in the top right of the email.

October 2025

October 2025 Sponsorship Insights

SPONSORSHIPS TO WATCH

Top New Sponsorships (national)

Top New Sponsorships, Jul-Oct (National)

The largest new deals in the last quarter were top tier partnerships amongst national properties - specifically Cricket Australia’s new Shirt Front partner in Westpac, and Super Rugby’s new naming rights sponsor in Swyftx.

A suite of new brands have entered Tennis Australia’s sponsorship portfolio (noting many of these have not yet been publicly announced).

Note of the 622 new sponsorships in the last 3 months, 364 were not announced publicly (60%), giving Scout Pro subscribers exclusive insights on the latest market movements.

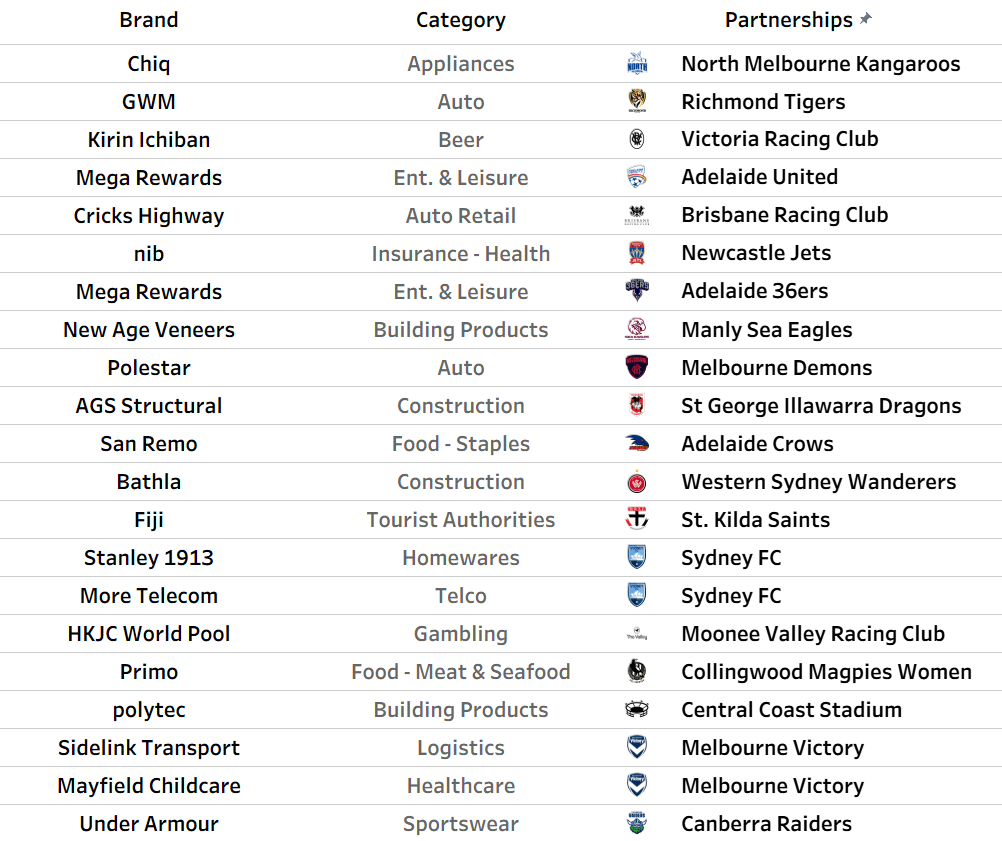

Top New Sponsorships (Club)

Top New Sponsorships, Jul-Oct (Club)

Other new deals include new Tier 1 partners for Richmond (GWM), North (ChiQ), Newcastle Jets (nib), W Sydney Wanderers (Bathla), amongst others.

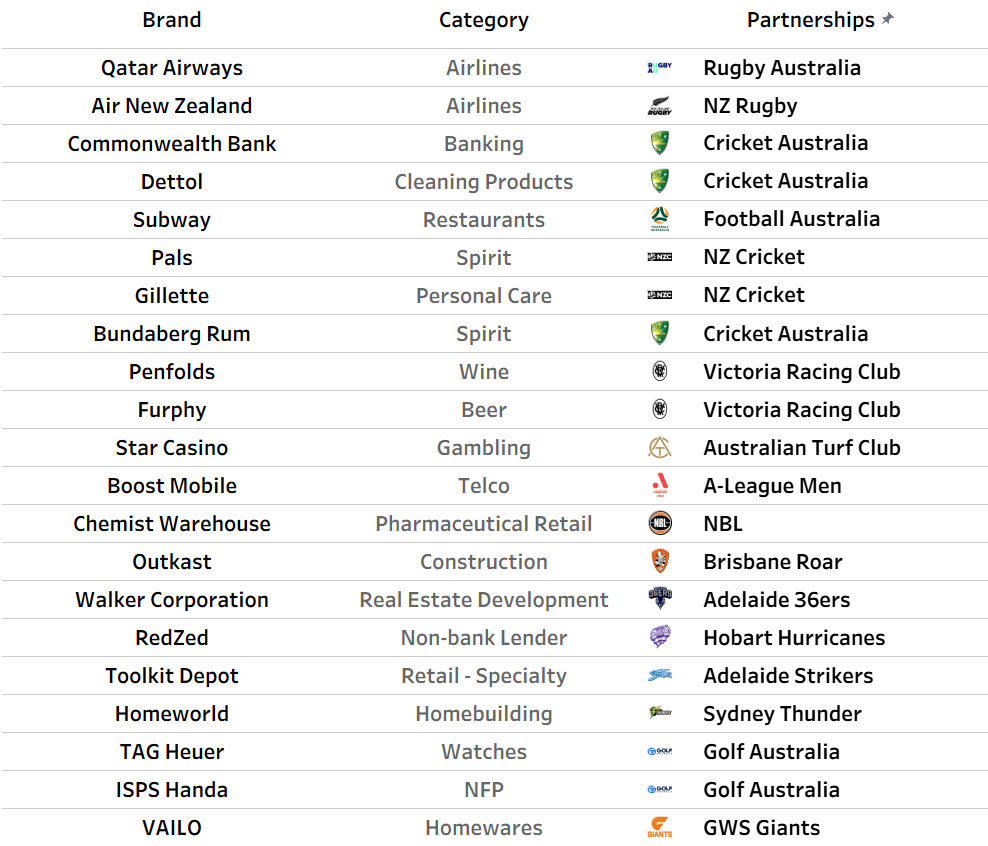

Top Expired Sponsorships

Top Expired Partnerships, Jul-Oct

The above brands are no longer listed as partners of their corresponding rights holder.

Many expiries represent shorter-term partnerships (e.g. Qatar Airways association with Rugby Australia for the Lions Tour in the last Quarter).

Others represent a change in partner (e.g. WestPac’s new partnership with Cricket Australia replaces CommBank).

Others represent a change in rights holder (e.g. Chemist Warehouse now partners with Cricket as its key summer sport, rather than NBL).

BRANDS TO WATCH

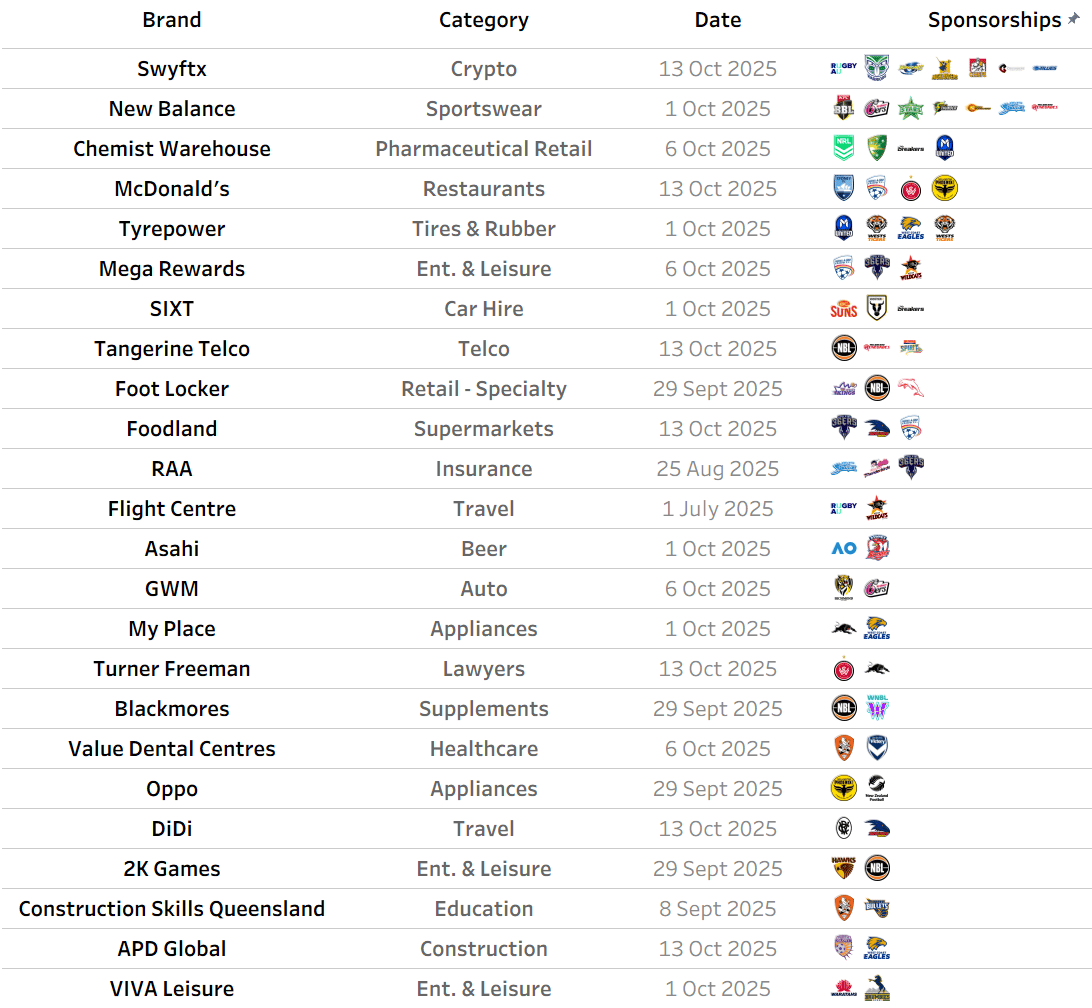

Most Active Brands (last quarter)

Most active brands (new partnerships & renewals), Jul-Oct

Swyftx has been the most active brand in the last 3 months, announcing new partnerships with Rugby Australia, NZ Warriors and the 5 x NZ Super Rugby teams.

New Balance has become the most active brand in Sportwear, as the new apparel partner in Big Bash, replacing Nike.

Chemist Warehouse, McDonald’s and Tyrepower - all in the top 10 for number of sponsorships - had busy quarters, with Chemist Warehouse signing major long-term deals with CA and NRL.

Top New Entrants (last quarter)

Top New Entrants, Jul-Oct

Taking the brands new to sponsorship, competition platform Mega Rewards has been the most active, with new partnerships with Adelaide Utd, 36ers and Perth Wildcats.

Other major entrants include companies across Construction (Bathla, ASC, Focus Construct), Logistics (Sidelink Transport, Oz Shipping, Cannon Logistics) and Spirits (Brookvale Union RTDs, Don Julio Tequila, Gospel Whiskey and Whiskymofo).

CATEGORIES TO WATCH

Most Active Categories (last quarter)

Most Active Categories, Jul-Oct

Crypto has been the most active category in the last 3 months. Of 18 sponsorships, 12 were announced as new / renewed / expired in the last 3 months (67%).

Other active categories with significant overall spend include Real Estate Development, Consumer Finance, Spirits, Supplements, Wine and Insurance.

The Insurance category has been particularly active in SA, where limited supply of opportunities has created more market tension, driving significant activity for RAA. Other teams with high SA viewership (e.g. AFL teams) may represent the next-best opportunities for brands to reach the Adelaide market.

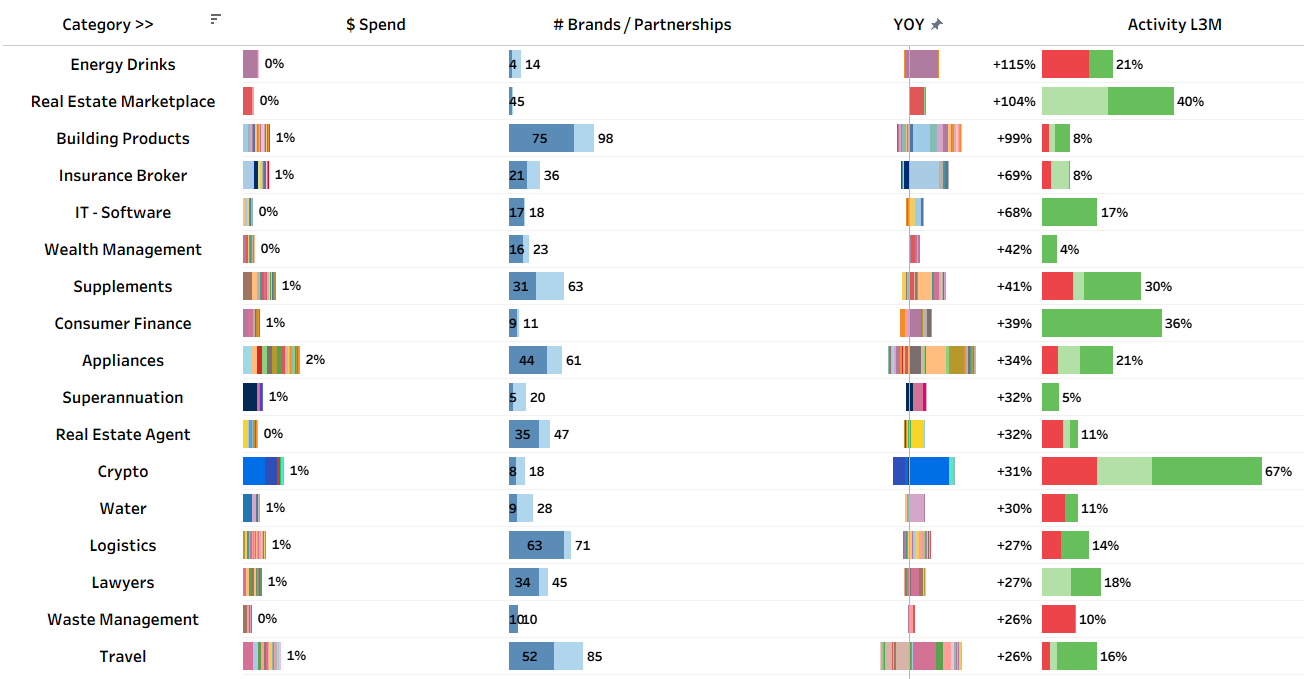

Top Growing Categories (last quarter)

Most Active Categories, year-on-year

The fastest growing categories of significant size include Building Products (e.g. James Hardie, Polytec, Reosteel, Bowens), Appliances (ChiQ, Shark/Ninja, Haier, Miele), and various specialised Finance categories, e.g. Insurance Brokers (e.g. Gallagher, Resilience), Wealth Management (e.g. Remara, PM Capital), Consumer Finance (e.g. Corpay, Clover).

Scout Services

📧 Scout Pro provides articles like this one, plus exclusive bonus insights, every month. Stay on top of key trends in sponsorship to support your activity.

Choose annual billing for exclusive access to the Scout Brand Directory. More information here.

💻 Scout Platform offers advanced features, visualisations and insights. Learn more here and reach out to Mark or Alex for a demo.