Good morning,

We’re excited to bring you Scout’s first Monthly Sponsorship Landscape Insights report.

We’ve heard from brands, rights holders, media and agencies seeking trends and insights on sponsorship activity. Using Scout’s sponsorship landscape database, we answer the following key questions:

What are the categories to watch?

The largest

The largest by Gender, Sport and State

The fastest growing

The most active

Which are the key brands to watch?

Top new partnerships

Top expired partnerships

Bonus: How can Scout help identify sponsor opportunities?

Sponsorship gaps in your market

Sponsorship weaknesses in your market

Scarce opportunities in your market

All Scout subscribers can enjoy the first three sub-sections for free. Get access to the full article with a two-week free trial of Scout Pro*.

Enjoy!

*more info on Scout subscription options

Problems with how this email displays? Click Read Online in the top right of the email.

June 2025

CATEGORIES TO WATCH

The largest sponsorship categories

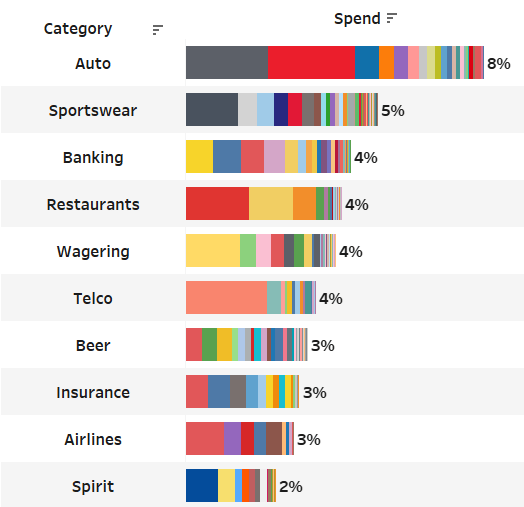

Largest sponsorship categories (% of all investment, coloured by brand)

Auto is the largest sponsorship category by spend, making up 8% of all investment. The chart colours represent the brands that make up this investment. For example, in Auto, KIA (black), Toyota (Red) and Ford (Blue) account for more than half of investment from the category.

Categories such as Wagering (Sportsbet) and Telco (Telstra) have clear market leaders. Rival brands need high-profile assets/sponsorships to compete.

Other categories are more fragmented (e.g. Beer), with more brands, but spending less. New brands are able to gain meaningful share with a lower spend OR have the chance majorly disrupt the category with a high profile investment.

Largest sponsorship categories - Women’s sport

Women’s Sport: Largest sponsorship categories (% of all investment, coloured by brand)

Looking at Women’s sport sponsorships, new categories emerge in the top 10, driven by different partnership objectives. Banking, Insurance and Health Insurance climb the ranks (NAB x AFLW, CommBank x Women’s Cricket, ANZ x Netball NZ, Suncorp x Super Netball, HCF/QBE x SSN Clubs, Medibank & TAL x AFLW, to name a few).

These categories tend to be more focused on reputational objectives. Mining is the category that skews its investment most towards Women’s sponsorship (jumping from 36th overall to 4th), with additional objectives to improve workplace gender diversity.

Wagering and Alcohol sponsorships drop out of the top 10, with a greater focus on reach, currently higher in Men’s codes.

Largest sponsorship categories, by sport

Top sponsorship categories, by sport

Partner objectives also drive differences in the top categories in each sport. Basketball’s fanbase skews towards youth and active families, attracting more investment from Retail (Kmart, Bunnings, Harvey Norman, Footlocker) and Supplements (Blackmores, Bulk, Musashi).

Categories with a strong focus on reach (e.g. Restaurants, Auto, Beer) are particularly strongly represented in the high broadcast codes; whereas other categories may prioritise audience alignment (e.g. AFL’s strong attendances and tendency to travel to support a team creates opportunities for Tourist Authorities).

Largest sponsorship categories, by State

Top sponsorship categories, by State

Local economies play a key role in category investment by State. For example, Mining and Energy are top categories in WA and SA.

Sponsor investment can also represent market dynamics in each State - for example the Banking landscape is more fragmented in QLD, and so more brands are active in sponsorship to compete for market share.

SA has some of the strictest gambling laws in the country, so that Gambling does not enter the top 10. None of the Victorian AFL Clubs have a Gambling partner, but the Horse Racing Clubs drive high Gambling investment in the State.

Other differences highlight opportunities - Auto, the largest category across the landscape is heavily under-invested in NSW and WA. New entrants may consider investing in these markets to drive stronger cut-through per $ spent, having to compete for fan attention with fewer competitors (note the difference in strategy between BYD x Roosters/NSW and KGM Ssang Yong x Magpies/VIC in recent high profile deals).

The fastest growing sponsorship categories (last 12 months)

Fastest-growing sponsorship categories (coloured by brand)

Investment from Energy drinks has grown fastest in the last 12 months, driven by 7 major new deals for Red Bull (AO, NRL, Panthers, Bulldogs, Auckland FC, Macarthur FC, Western Utd). Competitors such as Monster and V Energy may wish to respond to fight back for share of sponsorship.

Other key growth categories include Building Products (James Hardie, Bailey Ladders, Bowens), Appliances (SharkNinja, Haier, MyPlace, AirTouch), and Real Estate (Ray White).

The list is sorted by the fastest growing categories in the last 12 months on a % basis, noting some of these come from a small base. Travel, Health Insurance and Education have been some of the fastest growing categories in dollars spent.

Still to come (continue reading with a two-week free trial of Scout Pro):

What are the categories to watch? (continued)

The largestThe largest by Gender, Sport and StateThe fastest growingThe most active

Which are the key brands to watch?

Top new partnerships

Top expired partnerships

Bonus: How can Scout help identify sponsor opportunities?

Sponsorship gaps in your market

Sponsorship weaknesses in your market

Scarce opportunities in your market