Hi {{First name | there}},

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This week we take a look at the potential impacts of a regulatory crackdown on gambling advertising on the sponsorship market.

Enjoy!

Communications minister Michelle Rowland, whose portfolio covers gambling laws

The Scouting Report

Context

In June 2023, an inquiry into online gambling harm, chaired by late MP Peta Murphy, published its final report named “You win some you lose more”. It presented 31 recommendations for how the industry should be regulated.

Among them was a proposal for a phased ban on all advertising that directs consumers to websites and apps to place bets. This applies to television, radio, newspapers and online advertising.

According to Nielsen estimates, the gambling industry spent $310 million on advertising in 2022, however these figures do not account for the millions spent on sponsorship of stadiums, sports clubs and leagues.

The parliamentary committee heard evidence from the AFL and NRL in particular about their reliance on sponsorship revenue from betting companies as well as the cut of turnover from bets placed that some sporting bodies receive.

With the Government’s long awaited response to the inquiry due to be released soon, media reports have suggested that proposed bans would be watered down, disappointing those advocating for change.

Whilst it looks as though regulatory efforts will be tempered in the short-term, momentum is squarely in the camp of the anti-gambling movement. Polls indicate a vast majority of Australians want a ban on gambling advertising/sponsorships, which has resulted in bi-partisan support for crackdowns.

Below we investigate just how reliant sporting organisations are on gambling sponsorship and outline where the impacts of a ban would be felt greatest across the landscape.

Gambling and sponsorship

As of July 2024, Gambling companies account for 4% of all sponsorship investment, the 5th largest category. This is an estimated spend of $65M+ per annum.

Scout: Share of sponsorship investment by category (ANZ landscape)

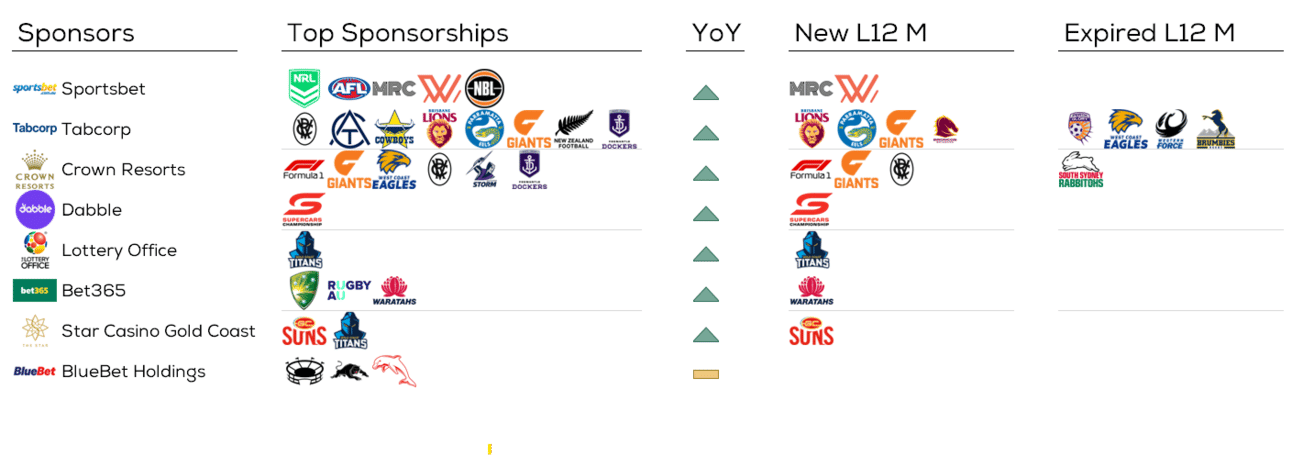

In the last 12 months, gambling has seen more activity than any other category, with over $10M spent on new deals:

Sportsbet became a top tier partner of the Melbourne Racing Club, on a five-year deal, replacing Ladbrokes and taking naming rights to Caulfield Cup.

Tabcorp signed mid-Tier deals earlier this year with Lions, Eels, Giants and Broncos, having let lower Tier WA-Club deals lapse.

Dabble and Lottery Office entered major league and team sponsorships through Supercars and Titans respectively.

Did the risk of impending legislation cause an acceleration in activity in sponsorship?

Scout - new Gambling sponsorships

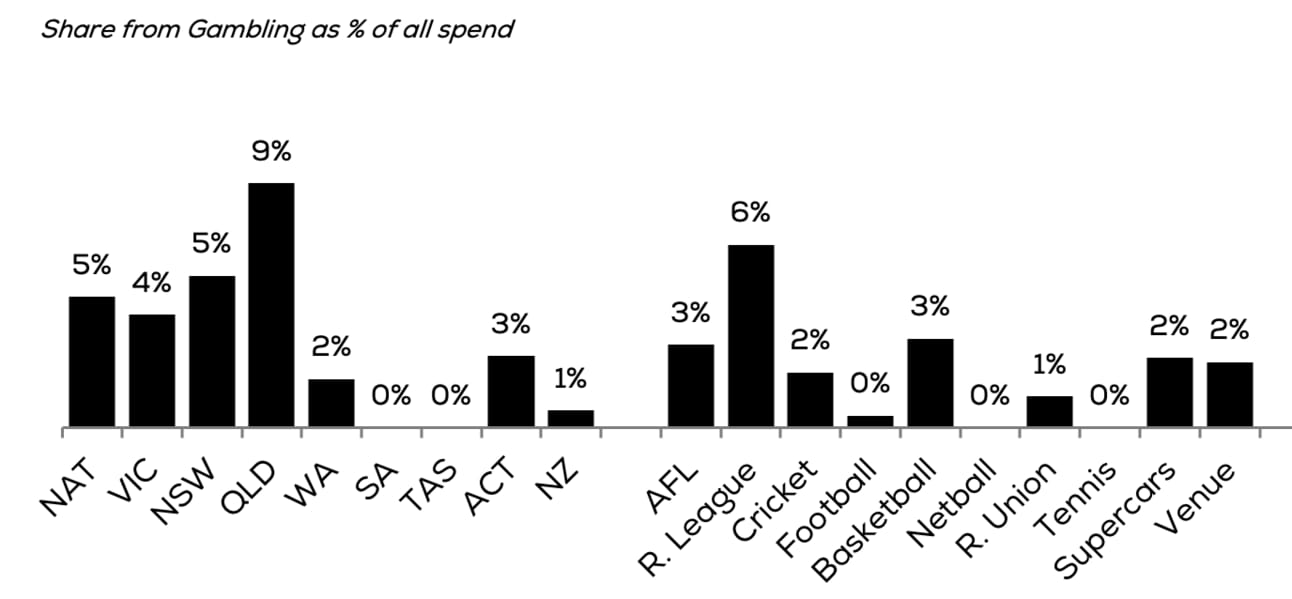

Spend varies a lot by state, which is largely the result of different regulatory frameworks:

Gambling is the highest spending category in QLD and NSW, at 9% and 5% of all spend respectively.

More than half of all QLD-based clubs and a third of all NSW-based clubs have a major gambling partner.

National bodies also rely heavily on gambling companies who provide 5% of all investment.

SA, where gambling legislation is strictest, has no gambling partnerships.

Scout - July 2024

Furthermore, certain codes have a much greater dependency on gambling sponsorship revenue than others, leaving organisations within these codes more susceptible to regulatory change:

Rugby League receives 6% of sponsorship revenue from gambling companies, more than double the next highest code, putting them at high risk.

AFL, Basketball, Cricket, Supercars and Venues are also at moderate risk with meaningful sponsorship contributions coming from gambling companies.

Tennis, Netball and Football are well placed to manage the effects of any regulatory change with little to no reliance on the gambling category.

At particular risk are the Manly Sea Eagles and Gold Coast Titans, who are the only organisations (outside of Racing Clubs) with a gambling partner as their Tier 1/Principal Sponsor. For these clubs, circa 20% of their sponsorship portfolio is at risk if regulatory reform was imposed. Those with Tier 2 gambling partners have approximately 5-10% of their sponsorship investment under threat.

Scout - Gambling Market Map - July 2024

Follow on LinkedIn for market maps including Responsible Gambling partnerships.

Summary

Whilst short-term regulatory changes to gambling advertising are likely to be minor, public sentiment and bi-partisan alignment mean that it is only a matter of time before significant reforms are put in place.

QLD and NSW sports organisations are at highest risk of revenue loss, particularly those in Rugby League and (to a lesser extent) AFL.

Clubs with a high proportion of sponsorship revenue coming from gambling should proactively consider long-term strategies to de-risk their future revenue through category realignment.

Where else should clubs be looking to fill the investment currently accounted for by these high-risk categories? Sign-up to Scout to find out.

Are you hiring? Get in touch with our partner business, Talent Economy.

Partner with industry experts, Talent Economy, to unearth top talent across the Aussie media, sport, entertainment and marketing sectors. Head to talenteconomy.com.au, follow on LinkedIn or email [email protected].