Hi {{First name | there}},

Welcome to the Scout Newsletter, an exploration into the data behind the Australian Sport and Sponsorship Landscape.

This week we compare market share and sponsorship share of voice in the Private Health Insurance market, following BUPA’s newly announced partnership with NZ Rugby.

Enjoy!

NZ Rugby signs BUPA as Official Global Healthcare Provider

The Scouting Report

Context

BUPA’s deal with NZ Rugby will bring its sponsorship share of voice (SOV) in line with its share of the Private Health Insurance category.

Health insurance sponsorship SOV was previously dominated by NIB, HCF and AIA, who have stolen market share in recent years.

Did BUPA and Medibank leave a sponsorship open goal? And will Medibank respond through a sponsorship portfolio befitting of its share of market?

Market share in PHI

Share of premium revenue (APRA 2023). Total: $27b.

BUPA and Medibank lead the Private Health Insurance (PHI) market in Australia, with a combined share of 50%. (Source: APRA 2023. General and Life insurance providers classified separately).

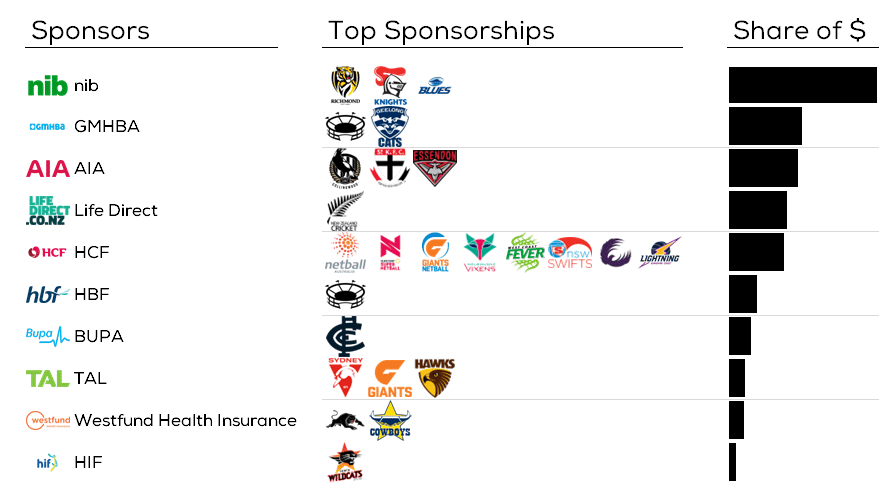

Sponsorship share in PHI

Private Health Insurance Brands, share of sponsorship spend

In terms of sponsorship, the category has been dominated by NIB (3 x T1 partnerships across codes and states), HCF (breadth in Netball), AIA (multiple VIC AFL teams), and other challenger brands.

Sponsorship share vs market share

PHI Sponsorship share of voice vs market share (pre NZR x BUPA)

Despite their market leadership, Medibank has no major sponsorships in Australian sport, while BUPA’s only Club partnership is with Carlton. Sports fans would be forgiven for assuming NIB was a market leader in health insurance.

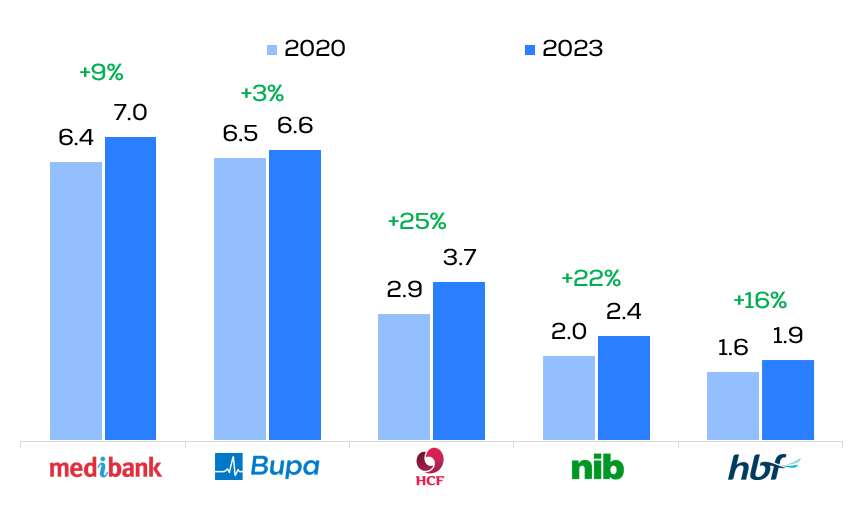

All things being equal, this excess share of voice leads to higher salience for those brands, and gains in share of market. This has already been reflected, with NIB, HCF and HBF seeing significantly more revenue growth than Medibank and BUPA in recent years.

Premium Revenue ($b), 2023 v 2020 (APRA)

Has BUPA and Medibank’s lack of sponsorship activity helped their competitors to seize more of the market?

What next?

BUPA’s newly announced partnership with NZ Rugby brings its sponsorship presence more in line with its market position, diluting rival brands, and providing BUPA with a platform to wrestle back market share.

Will Medibank respond with a sponsorship befitting its market leading position?

It is important to consider several contextual factors too:

PHI is a growing market, fuelled by increasing membership numbers since 2020. Being visible to new customers is therefore especially important.

Health insurance brands have a strong alignment with sport. According to BUPA, the NZ Rugby partnership will “promote healthy lifestyles globally”.

Several funds such as BUPA and AIA have an international presence, fitting for sports like Rugby, Cricket and Football, with large overseas audiences.

With Australia’s population continuing to grow (fuelled by migration), sports that reach new Australians (who are more likely to be making decisions on PHI provider) will be especially relevant.

Feb/March and June are key times for switching provider, ahead of premium increases and EOFY – reaching fans before these key times is likely to be especially appealing.

PHI investment is relatively higher in Clubland – with synergies in both sides being member-focused organisations, e.g. Club credit promotions when joining AIA.

Of course, each brand has different objectives, and despite slow growth in revenue in recent years, BUPA has seen stronger customer growth (at lower price points). Its association with NZ Rugby might instead focus on increasing its revenue per user.

To explore any of these themes further, or for another category, see our website or reach out for a chat: